I feel like I need to stop myself from googling “quote about starting a project” to come up with an introduction for this post. For some people, coming up with a catchy topic sentence is easy, but that has never been my strong suit. When I used to write papers in high school and college, I would often get stuck on the first sentence. I wound up writing the thesis statement, the rest of the paper, and then returning to the introduction just to find a quote that vaguely related to what I was going to say, and hope for the best. This is how I learned that “with great power comes great responsibility” was originally said by Spiderman. The more you know.

Looking back, I have always struggled getting started. Perhaps that is why I can never seem to go to the gym consistently; because I have to “get started” every day. I know this problem is not unique and I hope you can relate to this is some way. Budgeting in general was something I struggled to start doing and I had to restart many times before I found something that worked for me that I could consistently keep up with.

I became interested in money mostly out of necessity. I got my first job when I was 16 and really liked having my own money to spend however I wanted. I knew it was “important to save” but had no idea how much to save or what I was saving it for or even that there were different ways to save money! I just choose an arbitrary amount of money that seemed good, put it into savings with each check, and watched my savings grow. When I went to college, I had more saved than other people my age. I got lucky and had a good part time job that paid more on the weekends and gave raises every 6 months to a year.

I remember feeling conflicted about what to do with my savings and ended up just keeping my money in the same savings account for years until I graduated from college and got my first full-time job.

I thought I was doing ok. The summer after I graduated I moved in with some roommates and started teaching high school math in August. I had the same credit card from when I turned 18 that I used to pay for gas and then paid in full each month and a debit card that I used for pretty much everything else.

When it came time to start paying back my student loans, that is when I knew I was in trouble.

In hindsight, I made SEVERAL mistakes when it came to getting a college education. I went to a small, private college that cost $40,000 a year and I had no idea tuition would increase by ~$2,000 each year while I was there. I figured it would be fine. I looked around and saw all the other people who were somehow making this work and foolishly assumed we were all in the same boat. We were not.

I graduated with over $100,000 in student loans, mostly private, and ended up paying nearly $1,000 per month once repayment started. All of that, for a career where I made $38,000 my first year, with incremental increases each year. I quickly realized the math was not mathing. Ironically, my bachelor’s degree is in math but I failed to use those skills to think ahead about student loans. I, for some reason, had faith it would all work out. And so far it has, but not without significant sacrifices.

After my first year teaching, I changed school district to make more money and fulfill my TEACH grant requirements as to not increase the amount I owe the Government by another $25,000. This lead me to taking every coaching job I could (four total), working at home sporting events taking tickets, tutoring after school, and working at various jobs each summer.

After 5 years, I couldn’t do it anymore and decided to leave the teaching profession. I never thought I would be part of the 50% of teachers who leave within 5 years, but here I am!

Turns out, it’s really hard to get a job after teaching. My first job after teaching was at ISU, where I took a slight pay cut simply because I needed a paycheck. (if I worked with you at ISU, please know that I absolutely loved working with you and I miss it very much!!!!! <3)

I ended up working there for almost a year and this is when I really started budgeting. When I got my first paycheck from ISU, I wrote out all my bills and subscriptions, estimated how much I spend each month of food, gas, and other things, and realized I was about $200 short. Every month. For the foreseeable future. And I panicked. I had some savings but it had slowly been dwindling over the past year or so. I went through all my spending and cut back everything I could and then I got a second job. I knew I couldn’t budget off of vibes any longer and needed to get serious, but I was scared.

Like many things, I struggled to get started. For me, I had a lot of shame (still have a little probably?) about how I got into this situation in the first place.

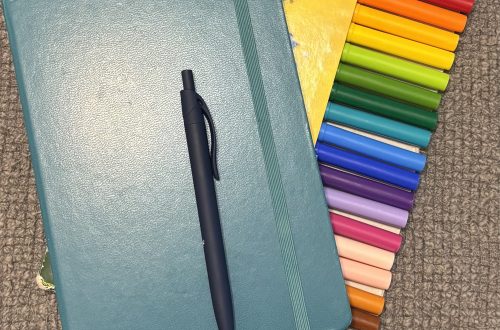

I don’t recall how it happened exactly, but I decided to try a new method to keep track of my spending: paper and pen (and brand new markers, obvi). I enjoy journaling and have always had a hard time finding the exact right planner for my needs to I decided to try bullet journaling and putting in a budgeting section. Now my bullet journal is only used for my budget and it works for me.

Fast forward to the present, and I have moved states, started a new job, and make more money than I ever have before. I have no idea what my life would look like if I had not started budgeting, probably significantly more stressful! The simple practice of budgeting has transformed my relationship with money in the best way, and all you need to do is get started.