There are so many different ways to budget, and I’ve failed at many.

As a young adult with one checking account, one savings account, and one credit card all issued by the same bank, I thought budgeting was as simple as opening up my banking app and checking the balances:

Did I get paid? Yes. Awesome.

Is my balance over $500? No…. oops. *transfers from savings to checking*

How is my savings doing? There’s money there. Good.

How much did I spend on my credit card? Is there enough in my checking to make the upcoming payment? Yes. Should probably cut back though.

Ok, everything seems to be in order! Moving on.

However, things evolved quickly as I started using my credit card more, rent increased almost every year, my car died, I needed a new car, etc, etc…. One thing was clear, I needed to get my shit together and be more intentional about my spending.

Budgeting Begins

My first (real) attempt at budgeting started several years ago when I tried creating a Google Sheet to keep track of all my spending but I was never satisfied with how it turned out. I couldn’t decide how to format it, it wasn’t something I could easily access and update, and it wasn’t very pretty. I spent so much time trying to build something that I could use for a long time and I could share with my friends to help them budget too, but it didn’t amount to anything. Once I had a version I thought would work, I would run into too many instances of not knowing how to categorize my spending and I ended up abandoning the project all together. I LOVE a good spreadsheet though! I knew they existed elsewhere, but I was not about to pay real money to access something I thought I could do on my own.

Next, I tried an app. I had been getting (targeted) ads for different money tracking app that were free and decided to give it a try. I signed up thinking it was too good to be true…. which it was. Nothing grinds my gears more than free things tricking you into getting them only to make you pay as soon as you try to do anything useful. This attempt at budgeting took all of 30 minutes before I logged off and never turned back. Admittedly, I could have put in more effort with this method but really didn’t want to pay for it.

I see the value in these paid for apps and budgeting tools and truly believe they can help people understand where their money is going and make changes that align with their goals. One of my favorite creators right now, Caleb Hammer of Financial Audit, came out with a budgeting app I would love to try, but haven’t gotten around to it yet since I know it is a paid service and I am not looking to add subscriptions to my budget right now, especially since I have a good thing going with my bullet journal.

In previous attempts, the need for a budget wasn’t super pressing, which may be why they ultimately failed. Since I had always kept track of my expenses, I knew as soon as I was underwater and really kicked it into high gear.

The Final Attempt (so far)

My goal became to create as much friction with each purchase as I could.

I turned on notifications for all my accounts so each time a transaction was made, I would get a push notification. This was helpful for a couple reasons: 1. probably a good security measure so I know if a transaction occurs that I didn’t authorize and 2. I could easily see each time I spent money (including automatic payments and subscriptions) and those notifications would stack to give me an idea of what I had spent in a day or a week. Side note: Should I be deleting my notifications more often??

To truly understand my spending, I finally decided to create an old fashioned, pen and paper budget in my little bullet journal. I sketched out how I wanted to set up the page, decided on my spending categories, and figured if I didn’t like it, it would be easy to change for the next month. Over the past two years, this is the budgeting strategy that has worked for me.

BuJo For the Win

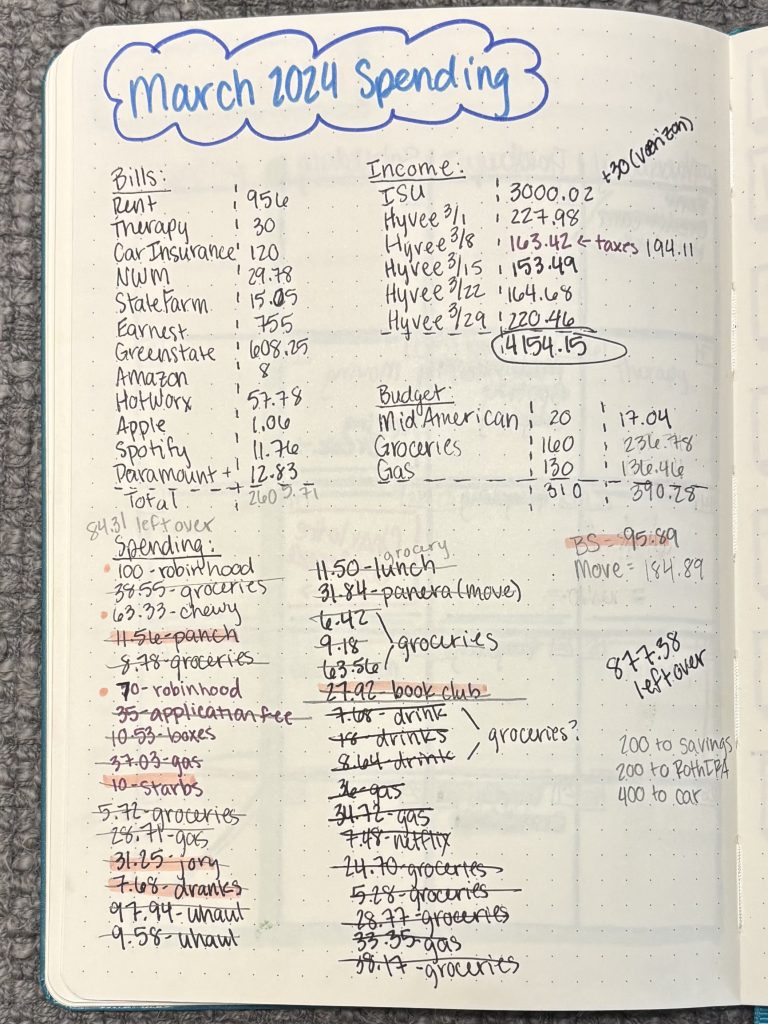

I created a list of my expenses that were the same each month, kept track of each paycheck and any random money I received, made a table of variable expenses like food and gas so I could estimate how much I would spend and then see where I ended up at the end of the month. Then, I listed out every. single. transaction.

By forcing myself to write down the dollar amount and what I spent it on, I had the opportunity to reflect on what I spent my hard earned money on, which was unexpected. I noticed that writing down purchases like gas and groceries felt pretty good because I knew I needed those things to survive and get to work. When I would write down purchases that would be considered “bullshit spending” i.e. things not needed for survival, I wouldn’t feel as good about it, so I did it less. I started being more intentional about my spending and asking myself “do I really need a medium iced coffee with French vanilla and almond milk from Dunkin’ today?” While the answer is occasionally “hell yeah,” the answer became “no” much more frequently.

This method may not be for everyone, and I want to take a moment to acknowledge that budgeting is not a one-size-fits-all thing. The most important part is finding what works FOR YOU! Money is highly personal and each person will be different. Creating a journal for my budget worked for me because it allowed me to reflect on my spending in a way that other methods did not. The intimacy of combing through each account and writing down what I spent my hard earned money on, combined with my trusty calculator app that I still use to balance my budget, made me feel in control of my spending like I never had before.